How to Streamline Risk Management in Financial Services with Data Lineage

Not surprisingly, industries related to health and wealth are among the most heavily regulated in the world; any discrepancies in their functioning can affect the quality of life of the public. For example, the instability of a large bank can affect the economy of a nation. In instances of heightened risks or threats to economic security, governments must impart their regulatory responsibilities to ensure the overall health of financial institutions remains satisfactory and the broader constituency is financially safeguarded and protected. The aftermath of the 2008 financial crisis is a good example, with its strict regulation of risk and the enactment of data privacy laws.

Government regulation also extends to customer data and consumer privacy. The introduction of the U.S. Data Privacy Act set down strict policies related to the retention of customer data, etc., in the financial sector. These regulations ensure basic protection from fraud and privacy violations for customers and investors. Banks and financial services firms may be subject to several federal and state restrictions if they’re found non-compliant.

Nations around the world have their own set of laws and regulations for risk and data privacy. Given the global reach of capital markets, financial institutions across the world encounter each other’s regulations. As a result, adhering to compliance has become extremely difficult and expensive.

3 Top Data-Related Compliance Questions Financial Services Firms Must Answer

At a foundational level, financial institutions must publish details about how they gather risk data as required by regulations, such as:

- Markets in Financial Instruments Directive II (MiFID II)

- Basel Committee on Banking Supervision’s standard number 239 (BCBS-239)

- General Data Protection Regulation (GDPR)

- Comprehensive Capital Analysis and Review (CCAR)

In view of the global impact of regulations, here are some critical questions institutions must be able to answer:

- How can our financial organization find and trace data to comply with regulatory compliance obligations?

- Our enterprise data undergoes numerous transformations involving legacy systems and business applications. How can our organization ensure transparency of data usage for reporting?

- Are our current reporting efforts being generated from valid and timely data?

A Powerful Spreadsheet Tool Overshadowed by Modern Requirements

It’s time to retire Excel to track large amounts of data. Excel sheets get outdated quickly. The application requires a subject matter expert to understand the data flow with the help of business analysts and developers. Spreadsheets can no longer cope with growing data volume, velocity and variety.

Banks must be able to demonstrate the data flow used to create risk reports. Automatically capturing data flow at scale, without the complexity of traditional programs like Excel, is a solution to accurate risk reporting in a constantly changing financial services compliance landscape. And the good news is, we already have a way to automate the capture of data flow. It’s called data lineage. Let’s go into more detail about what it is and why it’s important to banks and their growing compliance needs.

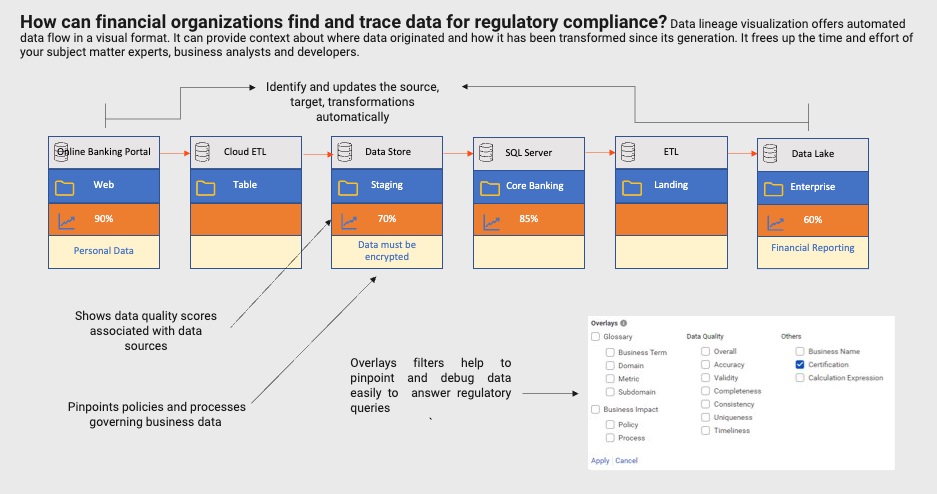

As mentioned in Figure 1, a data lineage capability can track all your enterprise data from source to target. It can help show how the data is transformed and ultimately whether it can be trusted. Data consumers can better comprehend data (schemas, tables, and columns) and see how the data moves through complex enterprise systems — visualizing its data lineage. Data consumers can also use overlays such as data quality, policies and processes to validate regulatory compliance and trust the data they are relying on.

How Data Lineage Simplifies Regulatory Compliance

Let’s look at how data lineage makes it easier to ensure accurate regulatory reporting and complying with regulations across geographies.

Markets in Financial Instruments Directive (MIFiD) II – You can use data lineage to identify trade reporting data gaps and any similarities between different regulatory reporting standards. Additionally, you can use it to track MiFID II reporting data from source systems to APAs (Authorized Publishing Authorities) and ARMs (Authorized Reporting Mechanisms) and vice versa.

Basel Committee on Banking Supervision (BCBS) – Data lineage implementation is required to support risk aggregation, data accuracy and reporting. This assures that risk data can be traced back to its source and that risk reports can be defended.

Financial institutions' business intelligence (BI) teams can use data lineage to show the full path of custody. No matter which BI systems are being used, a complete lineage from the source system to reporting can be viewed. They can also comprehend how any changes to the data ingestion, such as extract, transform and load (ETL), will affect various reports or the data downstream.

For enterprises that run numerous business intelligence (BI) systems in regulated sectors, this is beneficial. Importantly, regulators can investigate any errors in the data sources. They check to see if the data has been changed or manipulated in any way.

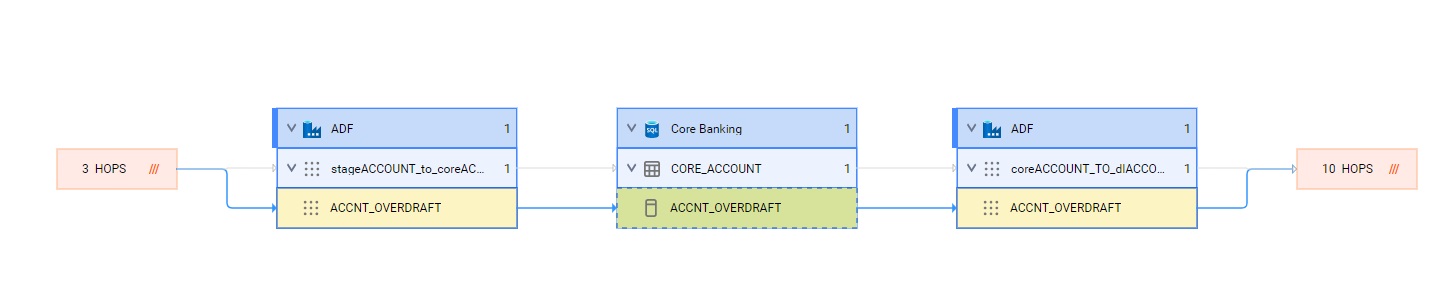

See the data lineage visualization of a core banking system in Figure 3 below for an example of how data can be traced back to its source.

Comprehensive Capital Analysis Review (CCAR) – CCAR needs attribute-level data lineage to trace data from source to destination and ensure the validity and veracity of capital plans. Data gaps in reporting and poor data quality can both be uncovered and highlighted via data lineage.

General Data Protection Regulation (GDPR) – For organizations subject to GDPR, data lineage is essential to track data and provide transparency about where it came from, where it is and how it is being used. Data lineage facilitates access to personal data and the execution of other rights, including the right to be forgotten from a data subject's standpoint. Additionally, it provides companies the chance to show that they follow the rules.

To see how Dutch multinational banking and financial services company Rabobank drives regulatory compliance with Informatica data lineage capabilities, watch this video.

Rein in Risk with the Intelligent Data Management Cloud for Financial Services

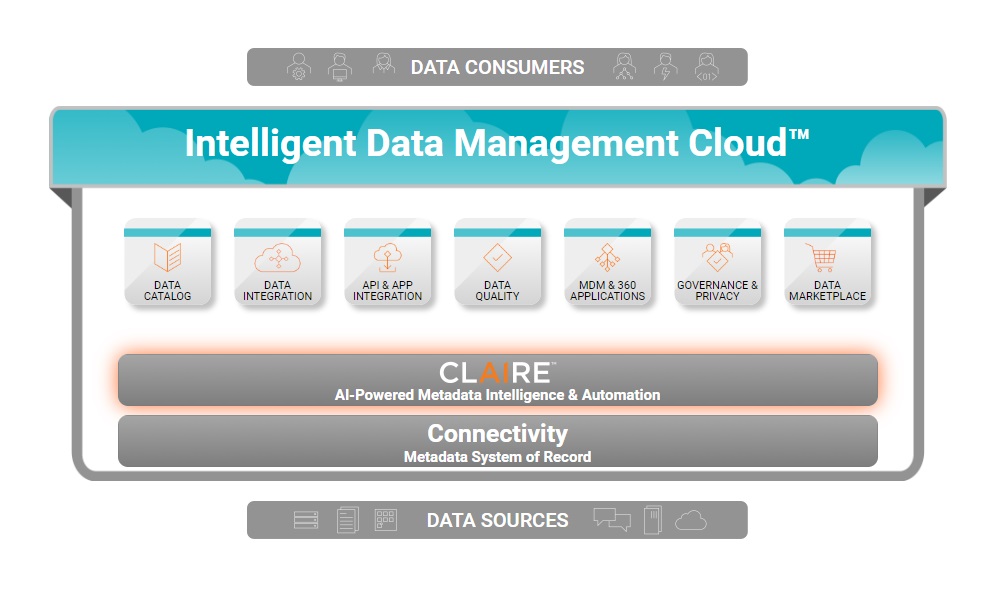

The Informatica® Intelligent Data Management Cloud™ for Financial Services helps financial services companies access and leverage fit-for-business-use data to support their top business priorities. Informatica Cloud Data Governance and Catalog (CDGC), a service of IDMC, helps compliance teams respond quickly to regulatory requests and ensure clean, valid and transparent data is used in regulatory report submissions.

Informatica CDGC helps you understand, analyze, interpret, add context to and govern key data assets in your organization. CDGC displays metadata that is extracted from various source systems (cloud data lakes, data warehouses, analytics/BI systems, databases, etc.) using a comprehensive catalog.

You can organize the metadata, view how data flows from one system to another and see relationships and links between the data assets. You can also document data assets, add business context to technical data assets, and govern the data as per your security and compliance requirements.

CDGC utilizes the AI capabilities of the Informatica CLAIRE® AI engine, which underlies the IDMC platform. CLAIRE provides smart recommendations to data owners and administrators to enrich governed assets.

Data lineage is a key feature of CDGC. You can start small with a single IDMC service as per your data requirements and slowly leverage the power of complimentary services to increase business agility and grow revenue holistically.

When new regulations are introduced, the chief data officer (CDO) must address the significant overlap in the data being governed. You can limit duplication efforts with CDGC. The data landscape for reporting is being impacted by the evolving reporting framework that financial organizations must adhere to. CDOs must understand where data is traded, what happens when it enters the data supply chain, and the reporting obligations when it is used in a report as a result. Data lineage is essential to ensure data is trusted and used responsibly by enforcing governance policies and standards.

Informatica CDGC is designed to visualize lineage and metadata for BCBS-239, MiFID II, CCAR, etc., allowing organizations to satisfy a regulator’s requirement for attribute-level data lineage. Data lineage is crucial for data-driven organizations operating in highly regulated industries like financial services and capital markets. It helps large organizations avoid human error, data quality issues and even becoming non-compliant. It gives unmatched control over your data and its history, along with the ability to quickly locate and correct any errors, streamlining regulatory compliance.

Next Steps

Read our blog, “4 Strategic Ways You Can Empower Data-Led Business Resiliency,” and check out our report based on a survey of 600 global data leaders.