The Role of Data in Mergers and Acquisitions

Last Published: Mar 17, 2025 |

Merger or Acquisitions (M&A) are still hot topics, so I thought I’d look at the role Data now plays in helping drive value as part of a Merger or Acquisition process.

The importance of managing post Merger and Acquisition data

It can be argued that the Merger and Acquisitions Due Diligence process (in part) evaluates the ‘fit’ of the prospective institutions, but should it evaluate the ’fit’ of the data as well? I would argue that it should, as one of key drivers behind many Mergers or Acquisitions is the desire to drive value from the synergies between the organisations. I would argue they can best achieve this when they can drive synergies from their data. An example could be up-sell or cross-sell activities between the individual institutions Customers. If we are evaluating data ‘fit’ then some basic questions should be asked including:

- How same, or different, is the data across the organisations?

- Where are there data similarities?

- Where are there data differences?

- How ‘compatible’ is the data?

So why does data ‘fit’ really matter in a post Merger and Acquisitions environment? For me, this is about understanding how quickly and easily the data from the individual institutions can be utilised to drive financial, compliance or reputational value. To understand the potential value impact of Data, then there are some questions we could be asking including:

- What’s the value of combining data, where appropriate?

- What data can be combined, and why?

- What insights does the combined data provide?

- How long will it take to combine the data?

Data Challenges in a post Merger and Acquisitions world

Achieving this value is probably not very easy. When we start to examine some of the reason behind this it soon becomes apparent that there is some work to do to make this happen. Some data challenges, from across the original institutions, to consider could include:

- Data may be captured, managed and maintained differently

- Data standards may be different

- Data processes, procedures and methods may be different

- Data quality may be different

- Data strategies may be different

- Data technologies may be different

- Data culture may be different

- Data sponsorship may be different

Potentially then, a number of important differences.

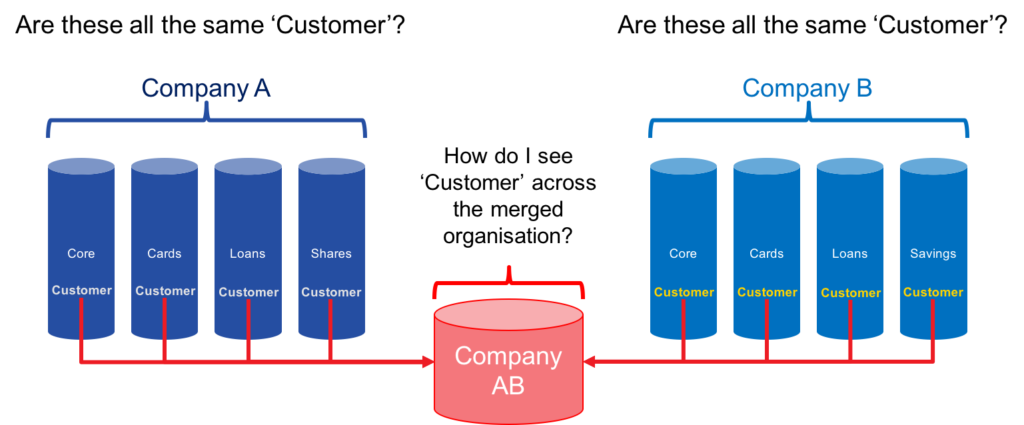

Example: Customer Data

Customer data is often an obvious starting point when considering post Merger and Acquisitions value. Institutions may be looking to utilise the larger pool of Customer data for up-sell, cross-sell, retention and win-back purposes. The diagram below illustrates both the potential opportunity and the potential challenge. Many institutions still don’t have a holistic, Single View of Customer that spans all aspects of the business. Imagine if both institutions in a Merger and Acquisitions process were in this position? Even if they both have a holistic, Single View of Customer there is still the challenge of creating this for the post Merger and Acquisitions world. For many, the objective will be to have a Single View of Customer that uses data from both parts of the new organisation

- The time taken to do this could have a material impact of the timing of value delivery as assumed through the purpose of the Merger or Acquisition

- The accuracy with which this happens could have a material impact on the effectiveness of the resulting activities that utilise this data (i.e. marketing campaigns)

- The completeness of the resultant data could have a material impact on the scale of any marketing or service activities that utilise it

- The resources used in doing this could be used for other purposes

An example of the challenges and opportunities data provides post Merger or Acquisition[/caption] An example of the challenges and opportunities data provides post Merger or Acquisition[/caption] |

Getting it right, however, creates a new pool of high–quality data which can be analysed, mined and utilised for many purposes – most of which will probably be contributing to the original value purposes behind the Merger or Acquisition.

What other potential Key Data Entities are there?

I’ve provided a list of the more common ones I come across. It’s not an exhaustive list, but hopefully you’ll get the idea:

- Product

- A potential source of the post Merger and Acquisitions product portfolio to understand how the portfolio aligns to Customers

- Service

- A potential source of the post Merger and Acquisitions Service portfolio to understand how this is applied to Customers and Products

- Contracts

- A potential source of the post Merger and Acquisitions Contract portfolio to understand how the portfolio aligns to Customers & Products

- Employee

- Understand how the new organisation aligns to Customers, Products, Services and Contracts

The Value of Data in post Merger and Acquisitions institutions

I see the two main value drivers to be:

- the creation of a new pool of information with the uses this enables for the new organisation

- the speed with which this happens having an impact of the speed of value delivery

In short, it's about:

- Creating more data…

- Combining ‘like’ data sets from the 2 organisations to create a larger pool of Key Data Entities. Examples include:

- Customers

- Products

- Services

- Contracts

- Employees

- … And doing it quickly

- The faster the ‘like’ data sets are combined, the faster value will be delivered to the new organisation

- Up-sell

- Cross-sell

- Retention

- Win-back

- Improved Service delivery

- The faster the ‘like’ data sets are combined, the faster value will be delivered to the new organisation

- Combining ‘like’ data sets from the 2 organisations to create a larger pool of Key Data Entities. Examples include:

Steps to take when dealing with Merger and Acquisitions data related issues

Here I’ve outlined some basic steps we could consider to help us tackle some of the Merger and Acquisitions data related issues.

- Identify the potential, future value associated with merging data sets

- Identify High Value, Key Data Entities (KDE) as merge candidates

- Profile and Assess the Key Data Entity sources to determine potential compatibility

- Quality Assess and remediate any data inconsistencies

- Match and merge data for Key Data Entities

- Determine if records relate to the same ‘Customer’

- If the same Customer, create a ‘Golden View’ of the Customer

- If not the same Customer, create 2 different ‘Golden Views’, 1 for each Customer

- Determine if records relate to the same ‘Customer’

This is obviously a very simplified set of steps. The idea is to get institutions thinking about the potential value of the data, post Merger or Acquisition, and what will be required to be available to deliver that value. This same approach can also provide the basis as a way to reduce the risk of data migration, as well as support the application retirement process (a typical outcome of a Merger or Acquisition).

Examples of companies who've successfully done this

BNY Mellon

- Rapidly integrate the data of the two merging banking organisations to more immediately realise synergies

- Enabled bank to quickly realise business benefits of merger, reduced cost of data integration on Asset Servicing project by 50% and combined client base, with minimal customer interruption

- Reduced costs across the global organisation

Turk Ekonomi Bankasi

- Target, acquire & retain customers better following the merging between TEB and Fortis Bank Turkey

- Enabled TEB to accurately target, identify and acquire customers, based on a more accurate view of the customer relationship

- Ensured staff can deliver a more personalised and rewarding service experience