Supercharge Your ESG Strategy with Intelligent Master Data Management

Environmental, social, and governance (ESG) issues affect key business decisions related to procurement, investment and partnerships across a range of industries. In the past few years, factors such as ESG-driven investments, government regulations and public perception have been driving companies to assess and report their ESG metrics and disclose their long-term strategy and ESG risk management plans.

At the same time, institutional oversight is increasing due to criticism of widespread “greenwashing.” To avoid fallout from misreporting, companies should practice the same rigor for ESG reporting as they do for financial reporting.

In this blog we will review the typical use cases that an enterprise ESG solution needs to address and discuss how an AI-powered master data management (MDM) solution can help you tackle the related data challenges.

3 Key Aspects of a Corporate ESG Solution

Let’s explore some of the most important requirements an enterprise ESG solution needs to address.

ESG Reporting/Disclosure

More than 90% of S&P 500 companies now publish ESG reports in some form.1 Countries around the world are proposing and enacting comprehensive sustainability disclosure requirements such as the Sustainable Finance Disclosure Regulation (SFDR),2 European Banking Authority Pillar 33 and SEC Climate-Related Disclosures Rules.4 Popular ESG reporting standards include SASB, GRI for complete ESG reporting, and GHG Protocol for accounting of direct/indirect greenhouse gas emissions. Disclosure platforms like CDP5 are used to share ESG data with investors and customers.

A typical ESG report includes the following dimensions:

- Environmental – data on topics like climate change, greenhouse gas emission, biodiversity impact, deforestation/reforestation, water management, pollution mitigation, etc.

- Social – data on topics like diversity, human rights, consumer protection, etc.

- Governance – data on topics like business ethics, transparency, shareholder rights, executive compensation, etc.

ESG Assessment and Rating

Corporate sustainability assessments are done by ratings providers like EcoVadis, Sustainalytics, Dun & Bradstreet, MSCI, S&P Global, etc. These ratings are often used by customers and investors to assess suppliers and investments. For example, many organizations are making supplier ESG assessments mandatory, especially for larger contracts. Often a third-party ESG rating provider will be used for the same.

ESG Strategy and Risk Management

Beyond disclosure of current ESG risks and opportunities, companies should also publish a near-term and a long-term strategy on how they plan to address and improve their current standings. Publishing definite, achievable targets and then reporting on the same is advised. One example of this could be a net-zero emissions plan by 2050 with intermediate shorter-term targets.

Beyond Reporting: Operationalizing Your ESG Strategy

As one can see, it is important for an organization to report accurate and auditable ESG metrics. Organizations are also often required to set specific ESG target metrics and deliver on those targets.

Accurate reporting backed by evidence involves identification and cataloguing the right dataset; fixing any data quality issues; enhancing and enriching existing datasets with external data (e.g., third-party assessments and ratings data, LCA and emission factors); and finally making the datasets available to the right people at the right time through data democratization.

To meet their declared targets, however, organizations need to operationalize their ESG strategy. This means, among other things, identifying products and the processes that have the highest footprint, identifying suppliers with the poorest ESG ratings and/or highest ESG risk, analyzing site/facility level energy consumption/ direct emission data and finally, feeding these insights back to the operational systems to make them part of the decision-making process.

The Advantages Multidomain Master Data Management for ESG

The Informatica Intelligent Data Management Cloud (IDMC) is uniquely positioned to deliver an end-to-end ESG data management solution that is critical to feed accurate, auditable and verifiable data to your reporting and analytics systems.

The multidomain MDM capabilities of IDMC, which include an assortment of business 360 applications, allow you to create and maintain unique, complete and consistent records of key entities like supplier, material, product, legal entity and site. They also help you discover and maintain key relationships between these entities. The reference data management capabilities maintain consistent enterprise code lists with crosswalk capability. Having accurate, auditable and verifiable master and reference data is essential for a number of tasks, including:

- Accurate supplier ESG assessment and rating

- Calculating supply chain emissions as part of scope 3 disclosures

- Assessing lifecycle emissions of products/services

- Improving materials sourcing and efficiency

- Meeting disclosure requirements related to taxonomy for sustainable activities

Let’s take a deeper look at some of these use cases and the role master data management plays.

- Identify ESG risk in your supply chain and enforce compliance: Informatica Supplier 360 makes it easy to integrate with external providers to bring in and maintain ESG ratings and assessments data along with the consolidated supplier profiles. This in turn makes it possible to engage with the right suppliers to reduce supply chain risk. You can also use this data for enforcing compliance.

- Calculate supply chain emissions as part of scope 3 disclosure: Using supplier classification and assessment data, identify tier-1 and tier-2 suppliers for emissions and/or activity data collection. Source primary emissions data and allocation ratios directly from suppliers for calculating your value chain emission (also known as scope 3). You can also use this data to evaluate supplier ESG performance.

- Calculate product footprints and improve materials sourcing: Informatica Product 360 helps you create a comprehensive 360-degree view to capture a holistic, detailed and accurate environmental footprint of a product. A multidomain material master solution helps identify products with the greatest potential for reductions and suppliers with the highest emission impact. These insights can help promote sustainability at the point of procurement of materials and engage with suppliers at a product/material level.

- ESG-driven investments and disclosure requirements: For investment firms and banks to disclose their ESG risks requires unique, unambiguous, and persistent identification of legal entities (such as issuer, counterparty) and legal entity hierarchies for assessment of total risk exposure.

How an IDMC-Based Solution Helps Streamline ESG Compliance

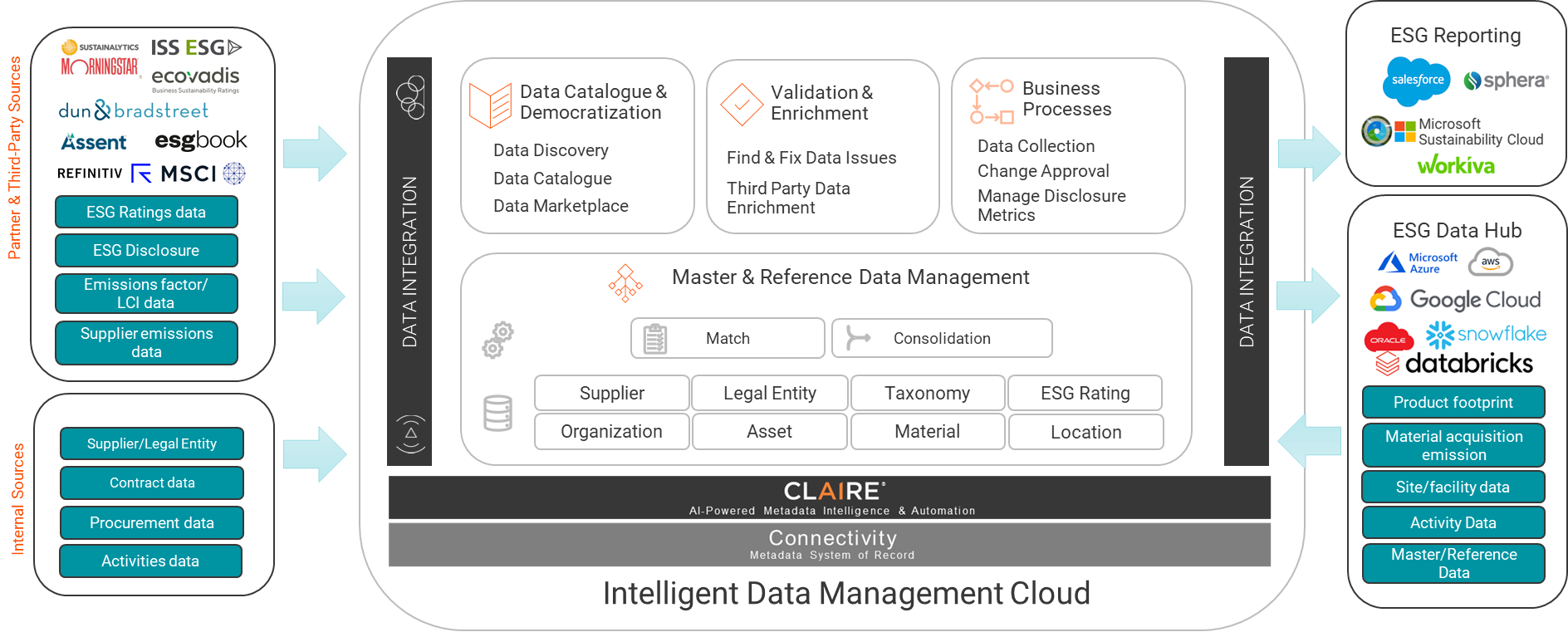

Figure 1. Informatica IDMC provides a range of services to streamline ESG compliance.

As shown in Figure 1, the following IDMC services enable you to streamline ESG compliance: Informatica Cloud Data Integration makes it easy to source master and transactional data from internal and external providers, thanks to its huge library of connectors; Informatica Data Quality verifies and fixes the data; Informatica Application Integration is used for the business process orchestration and API integration; and Informatica Master Data Management SaaS creates and maintains a 360-degree view of virtually all the key entities.

The validated, cleansed and standardized data is then moved to the reporting and analytics applications. Any insights thus gained can be fed back to master data management applications, which will help operational systems take advantage of the insights. Informatica Cloud Data Governance and Catalog is used for data discovery, data cataloging, data governance, data lineage and access to trusted data.

Jump-Start Your MDM Journey with Informatica Extensions

Informatica offers solution accelerators in the form of extension packages to help our customers jump-start their MDM journey. For your ESG journey you can evaluate the following extensions:

- The ESG extension for Supplier 360 provides visibility into your supplier network and their ESG performance. For more details, check it out here.

- The Legal Entity extension for Customer 360 helps you identify and assess legal entities such as counterparty and issuer. Find more details here.

- Learn more about the Intelligent Data Management Cloud (IDMC) for ESG Sustainability

1https://www.mckinsey.com/capabilities/sustainability/our-insights/does-esg-really-matter-and-why

2https://www.eba.europa.eu/regulation-and-policy/transparency-and-pillar-3

3https://www.eba.europa.eu/regulation-and-policy/transparency-and-pillar-3